The Bitcoin provide in revenue metric might trace that the present bear market hasn’t been painful sufficient but for the cyclical backside to be fashioned.

Bitcoin Provide In Revenue Has Plummeted To 45% Following Crash

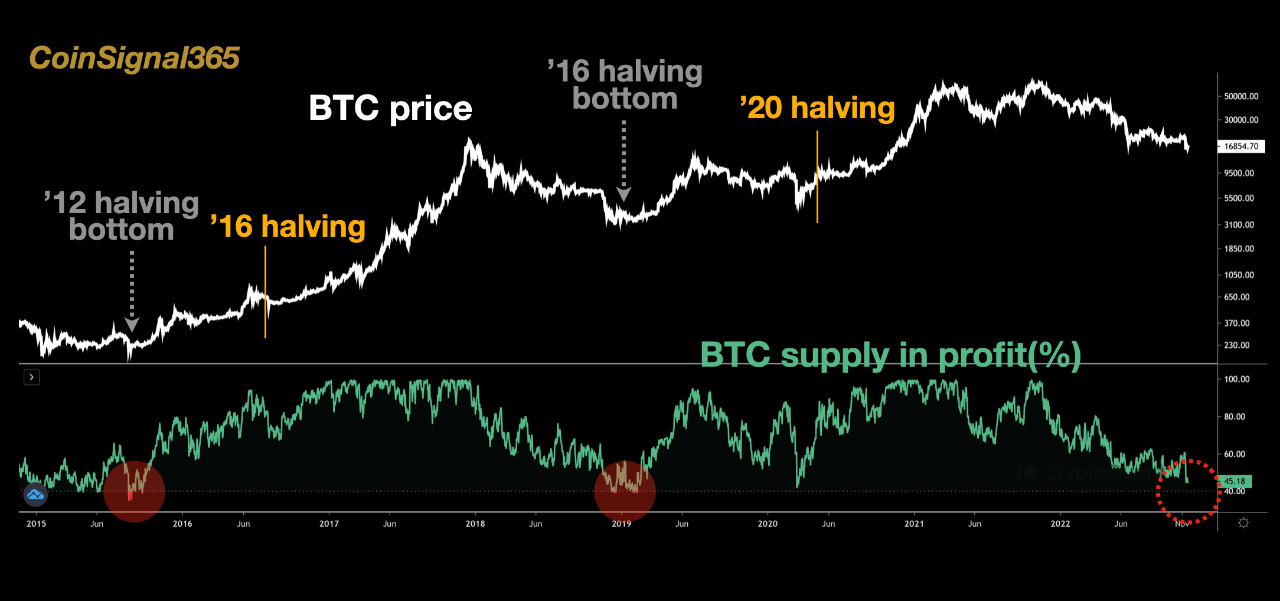

As identified by an analyst in a CryptoQuant post, all of the historic bottoms occurred when the revenue in provide dipped beneath 40%.

The “supply in profit” is an indicator that measures the proportion of the overall Bitcoin circulating provide that’s at present in some revenue.

This metric works by going by means of the on-chain historical past of every coin to see what value it was final moved at. If this earlier value for any coin was lower than the worth of BTC proper now, then that individual coin is carrying some revenue in the mean time.

The indicator takes the overall of such cash after which offers the proportion based mostly on the overall variety of cash in circulating provide. The alternative metric is the “supply in loss” and it’s merely calculated by subtracting the availability in revenue from 100.

Associated Studying: Despite Huobi Token’s 24% Decline In Past Week, Whales And Sharks Continue To Buy

Now, here’s a chart that reveals the pattern within the Bitcoin provide in revenue over the past a number of years:

The worth of the metric appears to have sharply dropped in current days | Supply: CryptoQuant

As you may see within the above graph, the proportion of the Bitcoin provide in revenue has plunged not too long ago because of the crash kicked off by the collapse of the FTX crypto exchange.

Following this plummet, the indicator now has a price of simply 45%. Which means greater than half of the overall provide has now entered right into a state of loss.

The chart additionally highlights the values of the metric that have been noticed through the bottoms of the earlier two halving cycles.

It appears to be like like lower than 40% of the Bitcoin provide was carrying some unrealized revenue in each of these bear market lows.

If the identical sample varieties this time as nicely, then it will imply the availability in revenue nonetheless has to drop by greater than 5 items with a view to hit the historic backside values.

Such a shift in profitability can solely happen after extra decline within the value, which suggests ache isn’t fairly over for Bitcoin buyers simply but.

BTC Worth

On the time of writing, Bitcoin’s value floats round $16.6k, down 6% within the final week. Over the previous month, the crypto has accrued 14% in losses.

Seems to be like the value of the coin continues to be persevering with its sideways motion | Supply: BTCUSD on TradingView

Featured picture from Hans-Jurgen Mager on Unsplash.com, charts from TradingView.com, CryptoQuant.com