Nothing shines a lightweight on the significance of power as a lot as a fast-approaching winter. When the temperature drops, the shortage of power turns into apparent and world efforts to protect it start.

This yr, the combat for power is extra aggressive than it’s ever been.

The fiscal and financial insurance policies set in place throughout the COVID-19 pandemic triggered harmful inflation in nearly each nation on this planet. The quantitative easing that got down to curb the results of the pandemic resulted in a traditionally unprecedented increase in the M2 money supply. This determination diluted the buying energy and led to a rise in power costs, sparking a disaster that’s set to culminate this winter.

CryptoSlate evaluation confirmed that the E.U. will most certainly be the one hit the toughest by the power disaster.

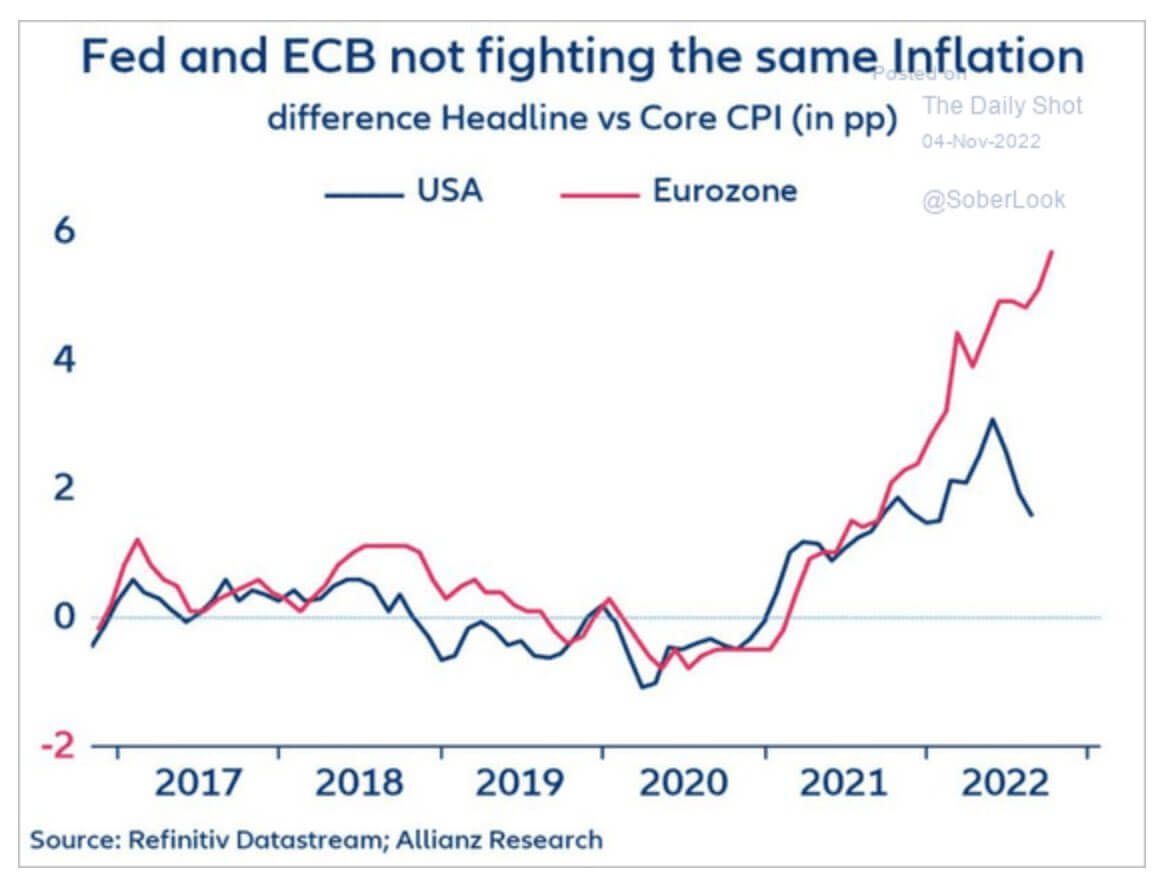

The European Central Financial institution (ECB) has been struggling to maintain core inflation down this yr. The Core Shopper Worth Index (CPI) started to extend considerably in 2021 as a result of pandemic each within the U.S. and the E.U.

The U.S. has seen its Core CPI lower sharply since its fruits in February and posted better-than-expected outcomes final month. Nonetheless, Core CPI within the Eurozone has continued to extend all year long and presently reveals no signal of stopping.

The same improve in Core CPI can be seen in Japan and the U.Ok. One of many components that will have contributed to their financial instability is an absence of funding and help for commodities like oil and gasoline. Widespread efforts to modify to renewable sources of power led to a lower in oil and gasoline purchases within the E.U. and the U.Ok.

In distinction, the U.S. and Russia have been investing closely in oil and gasoline and selling innovation within the discipline.

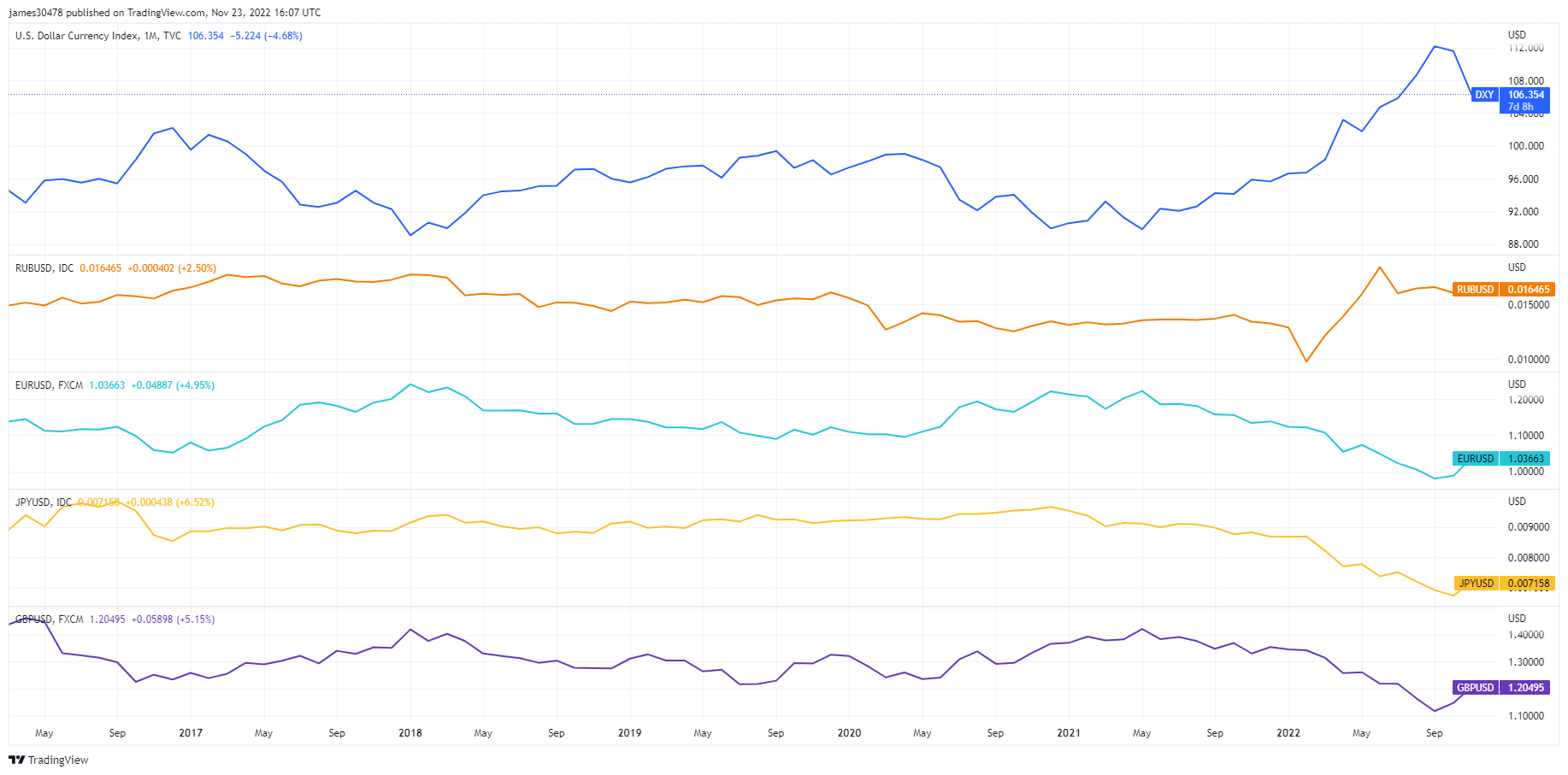

Wanting on the worth of fiat currencies towards the U.S. greenback additional confirms this affect.

The Russian Ruble and the DXY have each elevated in worth previously two years, whereas the euro, British Pound, and Japanese Yen have all seen their Greenback worth lower.

With rising inflation and a significantly weakened foreign money, the E.U. may have a tough time competing for oil and gasoline on the worldwide market. Pure gasoline producers warned that the majority long-term contracts for pure gasoline popping out of the U.S. have been offered out till 2026. Till then, when a brand new wave of pure gasoline provide is anticipated to return, the E.U. must compete with Asia for the restricted provide and swallow the excessive gasoline value.

All of this uncertainty may have a optimistic impact on Bitcoin. Whereas the broader crypto market struggles to stay afloat after the FTX fallout, Bitcoin has positioned itself as a pillar of stability in a market plagued with dangerous actors. Devalued fiat currencies may push retail buyers away from safe-haven belongings like gold and commodities and in the direction of an asset like Bitcoin.