An handle related to the BNB bridge exploiter has moved $74 million price of crypto to 0x5313, turning into the fourth-largest Rocket Pool’s rETH whale, blockchain security agency PeckShield reported.

In line with PeckShield, the crypto property transferred to the brand new wallet included 43,228 stETH, price about $70 million, 1,679 Rocket Pool’s rETH, price $2.9 million, and 771 ETH, valued at $1.27 million. The account additional swapped $7 million in crypto property, together with 6.2 million USDC and 472 ETH for 3,990 rETH.

BNB Exploiter: The Fourth-Largest Holder of rETH

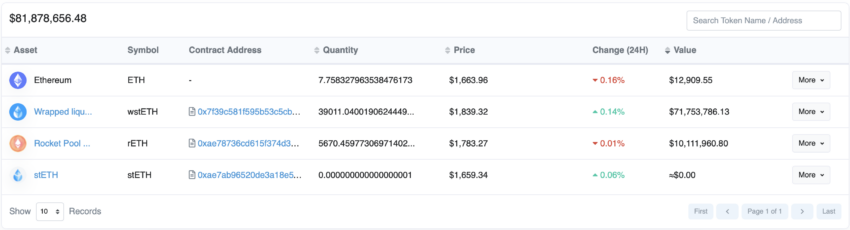

The 0x5313 is now one of many largest holders of staked Ethereum, with over $82 million in liquid staked ETH from the highest two platforms. This consists of 39,000 wrapped LDO, stETH, and 5,700 RocketPool staked ETH.

With its rETH holding valued at $10 million, the exploiter is now the fourth largest holder of rETH. RocketPool staked ETH and Wrapped Lido stETH are buying and selling at a premium to ETH itself.

The BNB bridge exploiter took advantage of a bridge vulnerability to steal 2 million BNB tokens valued at over $500 million in October 2022.

On the time, Binance determined to quickly pause the BNB Sensible Chain to stop the hacker from shifting the funds. The exploiter was solely capable of efficiently transfer about $100 million price of property earlier than the remainder have been frozen. Since then, the hacker has been utilizing decentralized protocols to maneuver property.

Arkham Intelligence knowledge shows that the address used 1inch to swap 33,000 ETH valued at $50 million for stETH. It additionally acquired 8.9 million price of stETH in two transactions from 0x68EA8. After transferring most of its property at present to 0x5313, the exploiter moved 0.2 ETH to 0x4Ad.

All these fund transfers seem like a part of a technique by the hacker to obfuscate his transactions. It is also a method to decrease losses after the exploiter misplaced 7.18 million JUSDTNative attributable to liquidation on his AVAX place.

DeFi exploits have been comparatively low this 12 months. PeckShield reported that there have been only $8.8 million in crypto losses attributable to exploits in January. That could be a 93% year-on-year decline from 24 exploits.

Disclaimer

BeInCrypto has reached out to firm or particular person concerned within the story to get an official assertion concerning the latest developments, however it has but to listen to again.